Empowering Merchants with Next-Gen Payments

Transform your customer’s payment experience with a platform managing over 180,000 terminals in 11 countries.

Consolidated Merchant Services

KasaPay is a distributer of highly innovative omni-channel point of sale solutions to the Lithuanian market.

Our core service is to provide merchants a consolidated offering of hardware and services under a single contract which includes onboarding, support, operations and billing.

Products

- In-store and eCommerce: credit and debit card payments

- PAX payment terminals: A99, A920Pro & A35

- SoftPOS mobile payments: accept payments anywhere

- Value added services: loyalty, tipping, split payments and more

- eSIM & SIM: compliment your wi-fi with a SIM

- Terminal accessories: covers, chargers and more

Services

- Consolidated contract & billing: a single contract and invoice covering all payment services.

- Onboarding & integration: self-service with extensive documentation or optional paid service.

- Customer support: AI built from the ground up. Ready to support you 24/7.

3 billion transactions

5 million cards

29 billion processed

180k terminals

11 countries

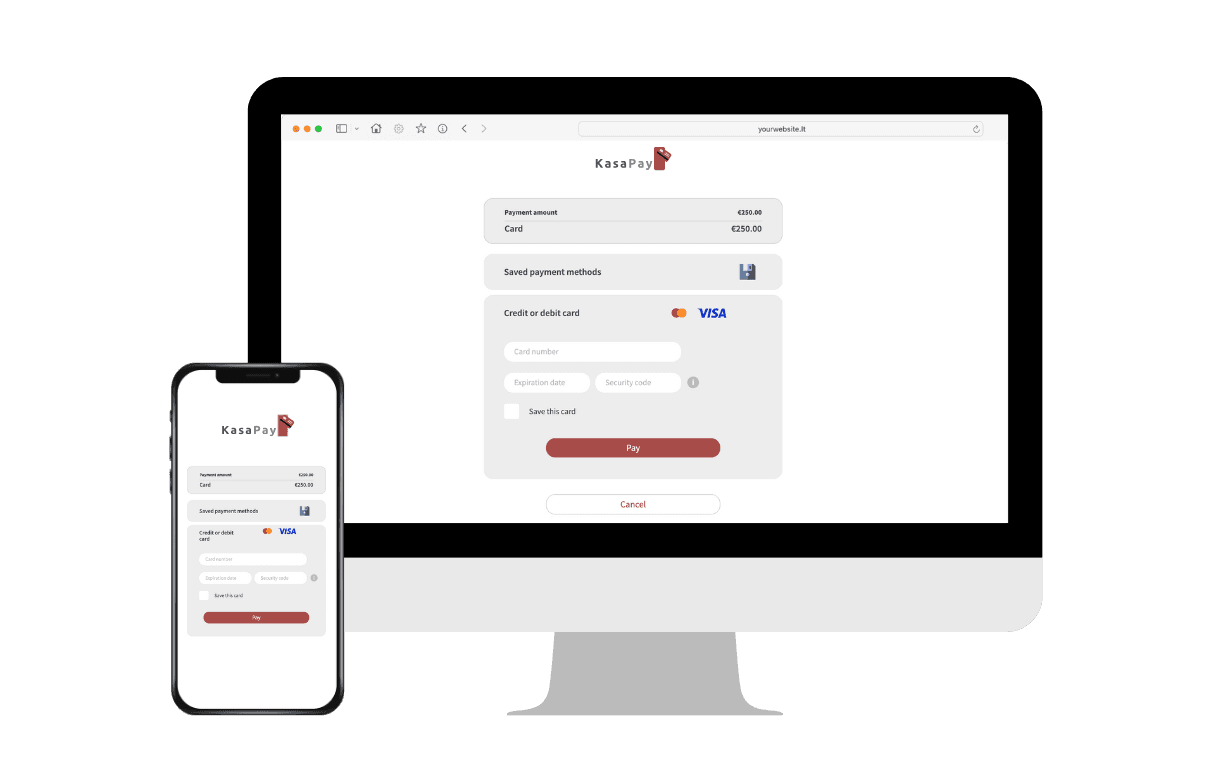

Unified Payment Platform

Bring all your payment needs under one roof with our extensive feature rich platform.

Superior features seamlessly integrated across our entire device ecosystem

- Visa, Mastercard, Apple Pay & Google Pay

- Accept online, in-store or on your mobile using card, swipe, contactless, QR code or Pay by link

- Increase payment completion rate by seamlessly integrating your website brand and colours.

- Remote terminal management system

- PCI DSS compliant Reliable

- 99.95% uptime

- ECR/POS integration

- Comprehensive documentation

- Exceptional customer support

- Self service or assisted installation options

- Optional integration services

Support for all major payment methods across multiple acceptance channels

- Visa and Mastercard

- Apple Pay and Google Pay

- Contactless payments

- QR code payments

- Pay by Link

- In-store payments

- Online payments

- Mobile payments

- Pay at Table

- Offline transaction support

PCI DSS certified payment platform

- Multi-layered security architecture

- Advanced anti-fraud systems

- Comprehensive risk management

- 24/7 security monitoring

- Real-time fraud detection

- Data encryption for all transactions

- Real-time fraud monitoring and prevention

- Tokenization for sensitive data protection

- Activity logging and monitoring

- SOC2 data centres

Ultra high availability platform

- 99.98% availability

- Dual site data centres

- Automatic backup acquirer routing

- Multi-layered technical support

- Offline transaction capability

Integrate your existing business systems with ease

- Simple ECR and POS integration via SDK or API

- Android app-to-app integration capabilities for standalone terminals

- Integration with value-added service providers such as:

- Loyalty

- Gift card

- Meal vouchers

- Lowest cost routing optimization

- Dynamic Currency Conversion

- Tips and gratuities management

- Cashback functionality

- Integrated loyalty programs

- Pay at Table to facilitate fast split payments

- Digital receipts via QR code or email

- Optional printed receipts

KasaPortal self-service merchant services & terminal management system

- Transaction reporting

- Account management

- Real-time monitoring

- User administration

- Merchant configuration

- Multi-language interface

- In-app and email notifications

- SaaS or API integration possible

- Computer, tablet, or mobile

- Receive software updates

- Configure value-added services

- ECR integration

- Customisation

Elevate your brand with these customisation option

- Terminal/device interfaces

- Seamless online integration with your own website’s colours

- Logo customisation (online)

- Color scheme adaptation

- Flexible configuration options

- Tailored checkout experience

Value added services to grow revenue, increase customer satisfaction and employee happiness

- User wallet capabilities to securely store and re-use cards

- Loyalty program integration

- Split payments

- Tips/gratuities

- Cashback

- Partner integrations

See how we’re transforming payment acceptance

Reach out to our team to discuss your project. Learn more about the payment platform processing some of the worlds largest merchants.

Frequently Asked Questions

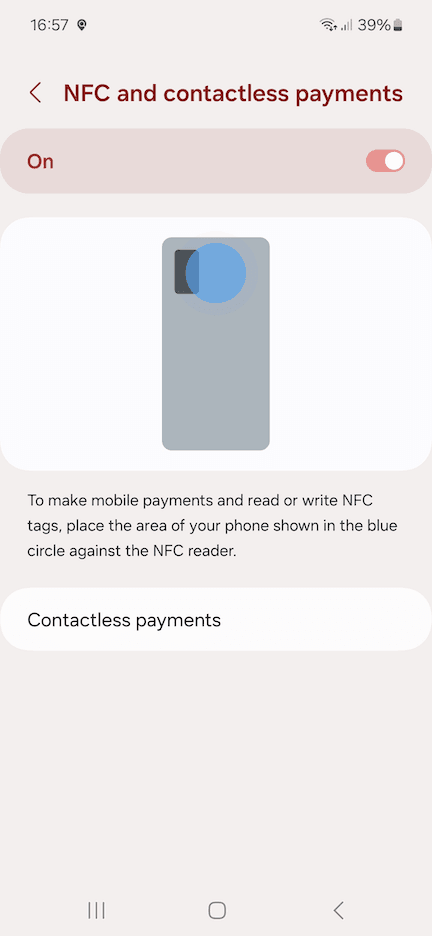

Where should I tap the customer’s card on my phone to take a payment?

When using the KasaPay Mobile Payments app to accept payments, the customer should gently tap their contactless card, phone, or wearable against the top center area on the back of your device.

This is typically where the NFC (Near Field Communication) antenna is located—the part of your phone that reads the card.

📍 Tip: On most Android phones, the NFC sensor is located just below or next to the camera on the back side of the phone, as shown below.

📱 Not sure where your NFC area is? Try the following:

- Go to Settings > Connections > NFC (menu path may vary by phone model).

- Look for any diagram showing the NFC location (Samsung devices often display this).

- Tap the card in different spots on the back of your phone until you find the “sweet spot.” Your phone will vibrate or display a prompt when the card is detected.

⚠️ Make sure:

- NFC is enabled on your device.

- You hold the card or device still for a second or two during the tap.

If the payment doesn’t go through right away, try:

- Tapping the card again.

- Adjusting slightly higher or lower on the back of the phone.

💳 Can I Accept Payments Over the €50 Contactless Limit with SoftPOS?

Yes, you can! 🙌

With SoftPOS, you’re not limited by the standard €50 contactless cap. If a transaction exceeds the cardholder’s contactless limit (typically €50 in Lithuania), the customer will simply be prompted to enter their PIN—right on your phone or tablet.

🔐 The Geeky Details...

SoftPOS uses “PIN on Glass” technology. This means the PIN is entered directly on your device’s touchscreen, no physical terminal needed.

Worried about security? Don’t be. The app is fully compliant with PCI DSS and SPoC (Software-based PIN Entry on COTS) standards, ensuring that sensitive data stays protected—just like with traditional card readers.

So yes, you can take higher-value payments easily and securely, all from your smartphone. 💼📱

Do I need a separate contract for different payment services?

It depends. KasaPay aims to simplify the process as much as possible and therefore, when possible and legally permitted, offers a consolidated agreement, covering all your payment services under a single agreement.

What are value-added services?

Value-added services (VA) include features like loyalty programs, tipping, split payments, mobile payment acceptance, and enhanced security.

These services help businesses improve customer experiences, grow revenue, streamline payment processes, and provide added flexibility, making it easier to manage transactions and build customer loyalty.

Can I accept payments with my mobile device?

Yes, KasaPay provides SoftPOS mobile payments, enabling you to accept payments anywhere using just your smartphone. This cost-effective solution is perfect for small businesses looking to process card payments without the need for purchasing or renting a terminal.

For larger businesses, mobile payment acceptance is an excellent way to manage high-traffic periods. By adding extra mobile terminals, you can reduce queue congestion, minimise customer frustration, and prevent abandoned purchases.

What types of payment terminals does KasaPay offer?

KasaPay offers the PAX payment terminals, including models A99, A920Pro, and A35, ideal for in-store in person payment acceptance.

Additionally, we can provide self-service terminals such as the PAX IM30 which is perfect for unattended use cases such as vending machines, parking meters, petrol pumps, and electric car chargers.

How do I get started with KasaPay’s payment solutions?

If you are not a customer yet, please contact us to arrange a call to discuss your requirements, get a demo, receive a proposal and understand the onboarding process.

How secure are KasaPay's payment solutions?

KasaPay's services are provided via Market Pay, a global fintech company. The company has achieved the highest level of PCI DSS (Payment Card Industry Data Security Standard) compliance, Level 1, ensuring robust protection of customer card data. This certification signifies adherence to stringent security standards, providing merchants with confidence in the safety of their payment transactions.

Additionally, Market Pay has implemented comprehensive security measures, including permanent attestation and monitoring services, to prevent fraud and malicious activities. These measures are equivalent to those used to certify and secure standard POS terminals, reflecting a commitment to maintaining high security standards

What types of payments can I accept with KasaPay?

You can accept payments via credit/debit cards (Visa, Mastercard), Apple Pay, Google Pay, QR codes, Pay by link, and more, both online and in-store.

Furthermore, for online payments, we can provide payment initiation services (account to account) supporting Swedbank, SEB, and Revolut.

Can I integrate the payment solutions into my existing system?

Yes, KasaPay offers integration options for both in-store POS and ECR systems as well as online via an extensive API. Comprehensive documentation, self-service tools, and guides are provided.

Paid integration services can be provided if you do not have a development team.

Where does KasaPay sell payment services?

KasaPay focuses on the Lithuanian market however we do have the capability to provide services globally via our partners.

What payment solutions does KasaPay offer?

KasaPay provides a range of payment solutions including in-store payments, eCommerce, mobile payments, and additional services like loyalty, tipping, and split payments.